Free 401K Planner Spreadsheet Templates

DESCRIPTION:

The 401(k) plan is a type of employer-sponsored retirement plan in the United States and some other countries, named after a section of the U.S. Internal Revenue Code. A 401(k) plan allows a worker to save for retirement while deferring income taxes on the saved money and earnings until withdrawal. The employee elects to have a portion of his or her wage paid directly, or "deferred", into his or her 401(k) account. In participant-directed plans (the most common option), the employee can select from a number of investment options, usually an assortment of mutual funds that emphasize stocks, bonds, money market investments, or some mix of the above. Many companies' 401(k) plans also offer the option to purchase the company's stock. The employee can generally re-allocate money among these investment choices at any time. In the less common trustee-directed 401(k) plans, the employer appoints trustees who decide how the plan's assets will be invested.

All assets in 401(k) plans are tax deferred. Before the January 1, 2006 effective date of the designated Roth account provisions, all 401(k) contributions were on a pre-tax basis (i.e., no income tax is withheld on the income in the year it is contributed), and the contributions and growth on them are not taxed until the money is withdrawn. With the enactment of the Roth provisions, participants in 401(k) plans that have the proper amendments can allocate some or all of their contributions to a separate designated Roth account, commonly known as a Roth 401(k). Qualified distributions from a designated Roth account are tax free, while contributions to them are on an after-tax basis (i.e., income tax is paid or withheld on the income in the year contributed). In addition to Roth and pre-tax contributions, some participants may have after-tax contributions in their 401(k) accounts. The after-tax contributions are treated as after-tax basis and may be withdrawn without tax. The growth on after-tax amounts not in a designated Roth account are taxed as ordinary income.

BENEFITS:

How should a 401K be balanced? According to Money magazine, the suggested allocations at three life stages are:

- Aggressive - for those with 35 or more years until retirement. (50% on large cap, 15% on bond, 15% on mid cap, 10% on small cap and 10% on international)

- Moderate - for those with 20 years until retirement (35% on large cap, 35% on bond, 10% on mid cap, 10% on small cap and 10% on international)

- Conservative - for those within 10 years of retirement (40% on large cap, 30% on bond, 10% on mid cap, 10% on small cap and 10% on international)

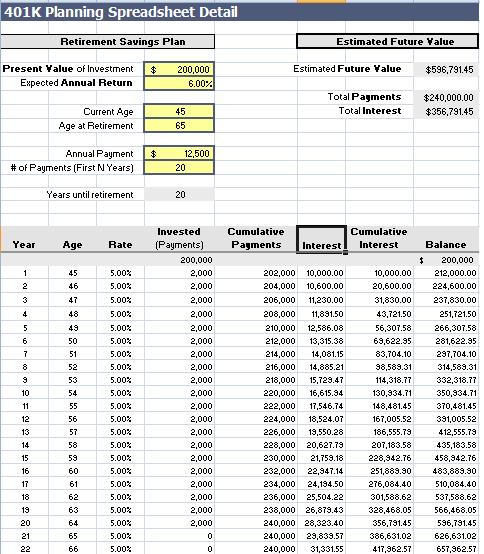

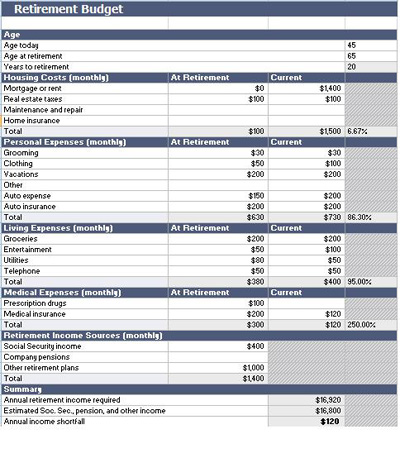

Here we put together the 401K and other retirement plans work/calculation work sheets, hope it will help you consider your own situlation and create your own retirment plan.

SYSTEM REQUIREMENTS:

Our software runs on any version of Microsoft® Excel® from 1997-2016.

SCREENSHOTS:

401K Planner Spreadsheet Tool Download (ZIP file)